SSE plc emerges as a formidable force in the UK energy landscape. This isn’t just a company; it’s a revolution in the energy sector, combining reliable electricity generation and transmission with a groundbreaking shift towards renewable sources like wind and hydroelectric power. Imagine engaging with an energy provider that doesn’t just supply power but does so with a commitment to sustainability and environmental stewardship. SSE stands out with its holistic approach to energy, offering a seamless blend of efficiency, innovation, and green technology, making it not just a choice but a statement for a sustainable future.

Alistair Phillips-Davies, the CEO of SSE plc, exemplifies the true essence of leadership and innovation. Just like the principles highlighted in the book, Alistair has taken full ownership of SSE’s direction, steering it towards groundbreaking achievements in renewable energy. His journey at SSE, starting in 1997, reflects a leader who embraces responsibility for every aspect of the organization, a key tenet of effective leadership. From his early roles in Corporate Finance and Business Development to his visionary leadership as CEO, he has consistently demonstrated the ability to make bold decisions.

Under Alistair’s guidance, SSE has not only grown in its traditional roles but has also taken giant strides in sustainable energy, marking significant contributions to wind and hydroelectric power. His background, including impactful roles at HSBC and National Westminster Bank and his academic grounding from Cambridge University, complements his leadership approach, combining expertise with a commitment to innovation and sustainable development. Alistair’s role as Vice President of Eurelectric further showcases his ability to lead beyond organizational boundaries, influencing the energy sector on a European scale. His leadership journey at SSE is a testament to the principles of owning every challenge and leading from the front, embodying the essence of accountability in the real world of business and sustainable energy.

SSE’s diverse energy portfolio, featuring renewable kings and queens like wind and hydro power, isn’t just a green move – it’s a strategic masterstroke. This isn’t just about harnessing the wind and waves; it’s about leveraging market trends and government incentives, a classic investment move to maximize returns.

SSE isn’t just about big moves; they’re about smart moves. Efficiency is their rook, sliding seamlessly across the board. They’re cutting costs, optimizing operations, and teching up, all while ensuring every investment penny is pulling its weight – twice over. This echoes the principle of minimizing fees and costs to maximize investment returns.

Expanding their customer base isn’t just a play for market dominance; it’s about diversifying and stabilizing their revenue streams. By offering competitive pricing and exceptional service, SSE is not just retaining customers but attracting new ones, mirroring the investment strategy of not putting all eggs in one basket.

Their strategic partnerships and acquisitions? It’s SSE’s way of spreading risk and maximizing opportunities – a nod to the investment rule of seeking growth and stability through diversification. Riding the wave of regulatory changes, SSE aligns with the principle of adapting to market shifts, reducing risks, and staying ahead in the game.

Innovation is where SSE really shines, aligning with the investment wisdom of looking for new opportunities and untapped potential. For SSE, the profit game is more than just numbers; it’s about sustainable growth and pioneering the future of energy. This is SSE – a blend of investment acumen, sustainable strategy, and sharp business prowess, leading the energy charge into a profitable, green future.

“At the forefront of their approach is a steadfast commitment to renewable energy, with wind and hydro power serving as more than just eco-friendly options; they are key drivers in SSE’s pioneering journey, placing the company well ahead of its competitors. This commitment extends beyond mere participation in the green energy trend to a strategic deployment of sustainable practices. SSE’s diverse energy portfolio, covering electricity generation to gas supply, showcases their adeptness in risk management and resilience against market fluctuations.

SSE’s innovation strategy integrates technology with energy, illuminating not just homes but also their market position. Their adherence to stringent regulatory compliance exemplifies a deep-seated ethos of total accountability, ensuring that their operations remain as ethical as their energy sources are sustainable. In customer service, SSE excels by turning challenges into opportunities and maintaining competitive pricing and reliability, further solidifying and expanding their customer base. They don’t just participate in energy policy discussions; they lead them, demonstrating proactive leadership. Overall, SSE’s approach is a blend of sustainability, innovation, and reliability, all focused on the customer. This isn’t just a game for SSE; it’s about shaping the future of energy with a strategy that exemplifies the very essence of competence and leadership.

SSE Thermal is making a strategic power play in the energy market, securing a game-changing 50% stake in the H2NorthEast blue hydrogen project in Teesside. This bold move not only exemplifies forward-thinking business acumen by taking decisive action towards innovation but also positions SSE as a leader in the UK’s energy transformation, targeting full decarbonization of power systems by 2035 and driving forward industrial decarbonization – a key step in the nation’s journey to net zero.

SSE’s financials paint a picture that’s a masterclass in strategic financial management – a mixed canvas of strategy and market response. On the one side, there’s a whopping £2,529.2 million in adjusted operating profits, a clear indicator of SSE’s strategic acumen and savvy investment decisions. However, turn the page and you’re faced with a reported operating loss of £146.3 million, a stark reminder of the inherent risks and volatilities in the energy market. The pre-tax narrative isn’t different: a solid £2,183.6 million in adjusted profits showcases SSE’s ability to capitalize on opportunities, while a reported loss of £205.6 million highlights the critical need for risk management, a core tenet of savvy investing. Earnings per share echo this duality: a strong 166.0p adjusted, juxtaposed with a (14.7)p reported figure. Topping it off, SSE’s substantial adjusted investment and capex of £2,803.3 million post-refunds and acquisitions reflect a bold, growth-oriented approach, aligning with the wisdom of seeking long-term value creation. SSE’s financial journey is more than numbers; it’s a strategic saga of balancing growth with caution, echoing key insights from seasoned financial strategies. Debt to equity ratio is 0.8548.

Maintaining Liquidity: In SSE’s financial playbook, maintaining strong liquidity isn’t just a tactic, it’s a principle. By ensuring a healthy cash reserve and accessible assets, they’re always ready to pivot and capitalize on emerging opportunities, demonstrating a proactive approach to financial stability.

Managing Debt Levels: SSE approaches debt with strategic precision, maintaining a balance that speaks to both cautious planning and bold market play. This fine-tuned debt management ensures agility and minimizes financial vulnerability, reflecting a leadership mindset in fiscal responsibility.

Cost Control and Efficiency: Efficiency at SSE goes beyond mere practice – it’s an operational ethos. They’re committed to optimizing every resource, integrating cutting-edge technology and refining processes, all aimed at driving maximum value from every investment.

Contingency Planning: At SSE, preparedness is paramount. Their approach to contingency planning involves a deep understanding of potential risks and crafting meticulous strategies, ensuring readiness to adapt and overcome any market adversity.

Strong Governance and Compliance: SSE’s commitment to governance and compliance is about more than following rules; it’s about setting the tone at the top. Their unwavering adherence to regulatory standards and ethical practices not only minimizes risk but also cements their reputation as a trustworthy market leader.

Current stock price (Closing 19/01/2024) £17.57 (1,757.00GBp).

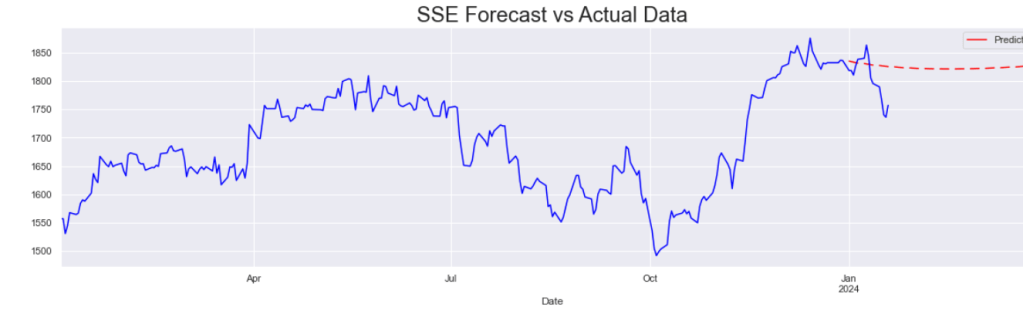

Over the last month, we are seeing resistance in the charts for SSE.L although over the last3 months we are in a bullish position and recovering from a massive drop from 1900GBp on 24th May 2023 to 1508 GBp on 4th October 2023. SSE.L is in a great position for swing trading profits however, reaching its all time high in 2023 suggest we could hold this renewable energy stock for a long term investment.

Over the past month, the charts reveal some resistance for SSE.L, yet the last three months paint a bullish picture, recovering impressively from a significant plunge from 1900 GBp on May 24, 2023, to 1508 GBp on October 4, 2023. This presents SSE.L as an ideal candidate for swing trading, capitalizing on these short-term movements. Additionally, reaching its all-time high in 2023 positions SSE.L not just as a short-term play but also as a potential long-term hold, particularly considering its focus on the burgeoning renewable energy sector.

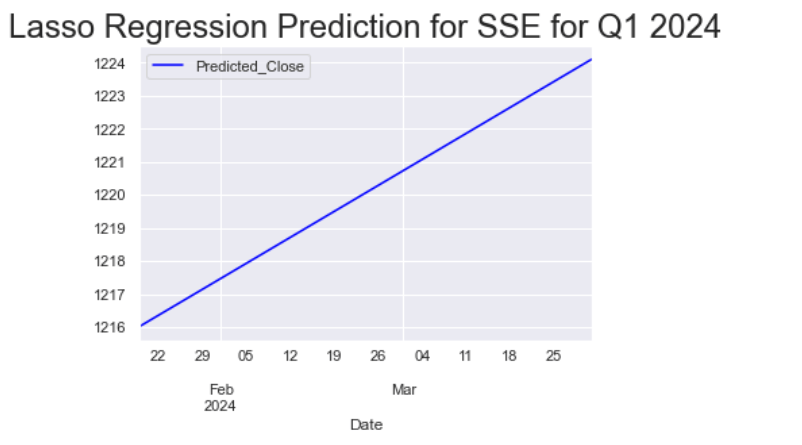

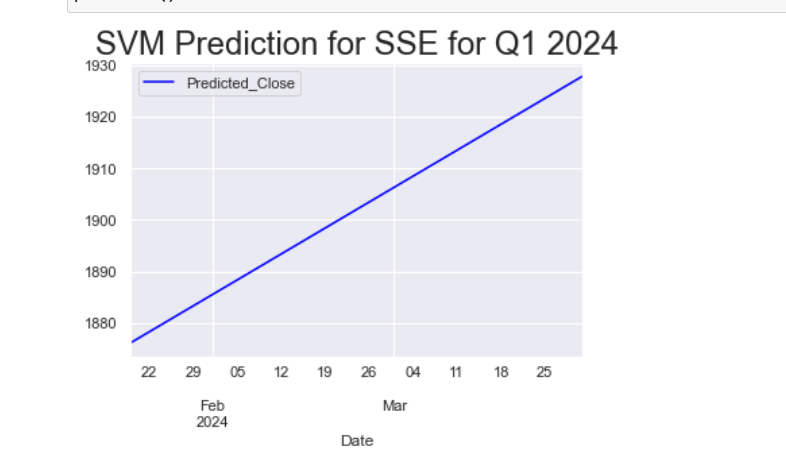

AI predictions for Q1 using ML supervised and unsupervised methodologies: sarimax, multiple linear regression, SVM, lasso regression and LSTM (RNN).

This blog was written by the founder Emmanuel Odunayo an Energy market expert analyst with previous experience in the low energy carbon consultancy and reservoir (petroleum) engineering for energy companies. This blog is an additional review to a portfolio that is going to be used for automation trading with energy, tech and crypto stocks with the use of algorithmic trading data science tools. This is not financial advise and viewers/readers are advised to do their own research.

Leave a comment